Risk Factor Diversification

Why isn’t traditional asset class diversification enough?

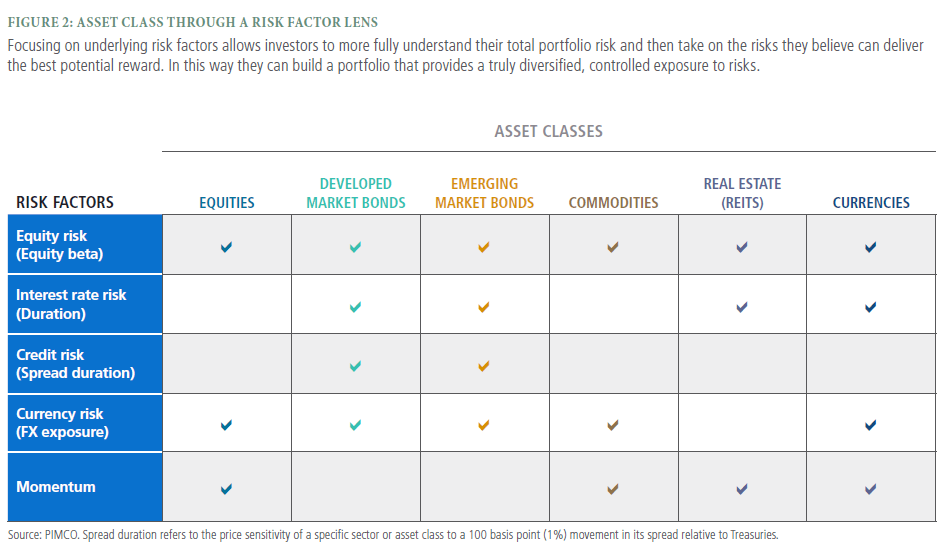

Traditional allocation strategies seek to mitigate overall portfolio volatility by combining asset classes with low correlations to each other, meaning that they tend not to move in the same direction at the same time. However, asset class correlations are less stable than many investors realize, and long-term trends such as globalization are driving correlations higher. In addition, correlations typically increase during periods of market turbulence. As a result, seemingly distinct asset classes are likely to behave more similarly than many people expect. In other words, even portfolios that are well diversified across asset classes may not be positioned to adequately diversify and cushion market volatility(Figure 1).

What is a risk factor?

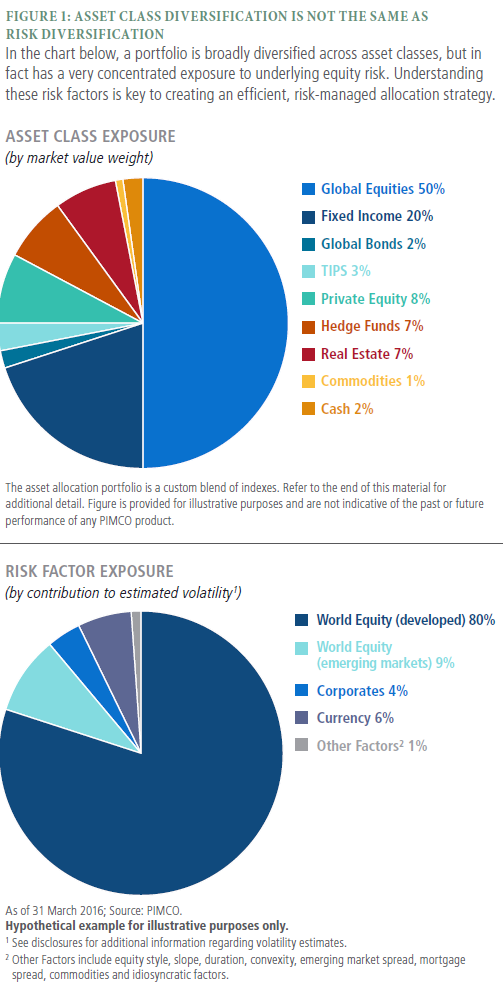

Risk factors are the underlying risk exposures that drive the return of an asset class (see Figure 2). For example, a stock’s return can be broken down into equity market risk – movement within the broad equity market – and company-specific risk. A bond’s return may be explained by interest rate risk – price sensitivity to changes in rates – and issuer-specific risk. And currency risk is a factor for assets denominated in foreign currencies. By targeting exposure to these underlying risk factors, investors can select a mix of asset classes that provides more diversified portfolio risk.

How does risk factor-based allocation work?

While it’s not possible to invest directly in a “risk factor,”using an allocation strategy based on risk factors can help investors more effectively choose a mix of asset classes thatbest diversifies their risks while also reflecting their viewson the global economy and financial markets.How would such a strategy work? By understanding the underlying risk factors within various asset classes, investors can ultimately choose which asset class allows them to most efficiently obtain exposure to that particular risk factor. For example, if they wished to add foreign currency risk to their portfolio, they could do so by investing directly in currencies, but they could also consider foreign equities, bonds or even commodities, if valuations seemed more attractive among those asset classes. Over time, that flexibility can help add significant value to a portfolio.

How can investors apply risk factor-based diversification to their portfolios?

Using a risk factor-based approach requires a forward-looking macroeconomic view on a wide range of variables, including monetary policy, geopolitical developments, inflation, interest rates, currencies and economic growth trends. Because few individuals have the resources or infrastructure to continually monitor these factors, it may make sense for them to talk to their financial advisors about funds that use such an approach.

Disclosures

All investments contain risk and may lose value. Diversification does not ensure against loss. Investors should consult their investment professional prior to making an investment decision.

The asset class exposure model presented herein for illustrative purposes only. The allocation model is based on: S&P 500 (U.S. Equities), MSCI EAFE Net Dividend Index in USD (International Equities), MSCI Emerging Markets Index (Emerging Market Equities),Barclays Capital US Aggregate Index (U.S. Bonds), HFRI Fund Weighted Composite Index (Absolute Return), Dow Jones UBS Commodity TR Index (Commodities), Cambridge Associates LLC U.S. Venture Capital Index® (Venture Capital), Cambridge Associates LLC U.S. Private Equity Index® (Private Equity), NCRIEF Property Index (Real Estate). It is not possible to invest directly in an unmanaged index.

VOLATILITY (ESTIMATED)

We employed a block bootstrap methodology to calculate volatilities. We start by computing historical factor returns that underlie each asset class proxy from January 1997 through the present date. We then draw a set of 12 monthly returns within the dataset to come up with an annual return number. This process is repeated 25,000 times to have a return series with 25,000 annualized returns. The standard deviation of these annual returns is used to model the volatility for each factor. We then use the same return series for each factor to compute covariance between factors. Finally, volatility of each asset class proxy is calculated as the sum of variances and covariance of factors that underlie that particular proxy. For each asset class, index, or strategy proxy, we will look at either a point in time estimate or historical average of factor exposures in order to determine the total volatility. Please contact your PIMCO representative for more details on how specific proxy factor exposures are estimated.

This material contains the opinions of the author but not necessarily those of PIMCO and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO provides services only to qualified institutions and investors. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660 is regulated by the United States Securities and Exchange Commission. | PIMCO Europe Ltd (Company No. 2604517), PIMCO Europe, Ltd Amsterdam Branch (Company No. 24319743), and PIMCO Europe Ltd - Italy (Company No. 07533910969) are authorised and regulated by the Financial Conduct Authority (25 The North Colonnade, Canary Wharf, London E14 5HS) in the U.K. The Amsterdam and Italy branches are additionally regulated by the AFM and CONSOB in accordance with Article 27 of the Italian Consolidated Financial Act, respectively. PIMCO Europe Ltd services and products are available only to professional clients as defined in the Financial Conduct Authority’s Handbook and are not available to individual investors, who should not rely on this communication. | PIMCO Deutschland GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany) is authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie-Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 32 of the German Banking Act (KWG). The services and products provided by PIMCO Deutschland GmbH are available only to professional clients as defined in Section 31a para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. | PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2), Brandschenkestrasse 41, 8002 Zurich, Switzerland, Tel: + 41 44 512 49 10. The services and products provided by PIMCO (Schweiz) GmbH are not available to individual investors, who should not rely on this communication but contact their financial adviser. | PIMCO Asia Pte Ltd (501 Orchard Road #09-03, Wheelock Place, Singapore 238880, Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited (Suite 2201, 22nd Floor, Two International Finance Centre, No. 8 Finance Street, Central, Hong Kong) is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862 (PIMCO Australia) offers products and services to both wholesale and retail clients as defined in the Corporations Act 2001 (limited to general financial product advice in the case of retail clients). This communication is provided for general information only without taking into account the objectives, financial situation or needs of any particular investors. | PIMCO Japan Ltd (Toranomon Towers Office 18F, 4-1-28, Toranomon, Minato-ku, Tokyo, Japan 105-0001) Financial Instruments Business Registration Number is Director of Kanto Local Finance Bureau (Financial Instruments Firm) No. 382. PIMCO Japan Ltd is a member of Japan Investment Advisers Association and The Investment Trusts Association, Japan. Investment management products and services offered by PIMCO Japan Ltd are offered only to persons within its respective jurisdiction, and are not available to persons where provision of such products or services is unauthorized. Valuations of assets will fluctuate based upon prices of securities and values of derivative transactions in the portfolio, market conditions, interest rates and credit risk, among others. Investments in foreign currency denominated assets will be affected by foreign exchange rates. There is no guarantee that the principal amount of the investment will be preserved, or that a certain return will be realized; the investment could suffer a loss. All profits and losses incur to the investor. The amounts, maximum amounts and calculation methodologies of each type of fee and expense and their total amounts will vary depending on the investment strategy, the status of investment performance, period of management and outstanding balance of assets and thus such fees and expenses cannot be set forth herein. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | PIMCO Latin America Edifício Internacional Rio Praia do Flamengo, 154 1o andar, Rio de Janeiro – RJ Brasil 22210-906. | No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2016, PIMCO.