Credit Default Swaps

- Credit/Default risk: The risk of loss of principal or loss of a financial reward stemming from a borrower’s failure to repay loan or otherwise meet a contractual obligation.

- Central Counterparty (CCP): A clearing house that interposes itself between counterparties to contracts traded in one or more financial markets, becoming the buyer to every seller and the seller to every buyer and thereby ensuring the future performance of open contracts.

- Counterparty risk: The risk to each party of a contract that the counterparty will not live up to its contractual obligations.

- Corporate bond: Debt instrument issued by a private corporation, as distinct from one issued by a government or government agency.

- Credit spread: The yield differential between a corporate bond and an equivalent maturity sovereign bond. For example, if the 10-year Treasury note is trading at a yield of 3% and 10-year corporate bond is trading at a yield of 4%, the credit spread if 1% or 100bps.

- Derivative: A security which derives its value from movements in an underlying security, such as stocks, bonds, commodities, currencies and interest rates.

- Interest rate risk: When interest rates rise, the market value of fixed income securities (such as bonds) declines. Similarly, when interest rates decline, the market value of fixed income securities increases.

1 As of 30 June 2016. Source: BIS

What is a credit default swap?

A CDS is the most highly utilized type of credit derivative. In its most basic terms, a CDS is similar to an insurance contract, providing the buyer with protection against specific risks. Most often, investors buy credit default swaps for protection against a default, but these flexible instruments can be used in many ways to customize exposure to the credit market.

CDS contracts can mitigate risks in bond investing by transferring a given risk from one party to another without transferring the underlying bond or other credit asset. Prior to credit default swaps, there was no vehicle to transfer the risk of a default or other credit event, from one investor to another.

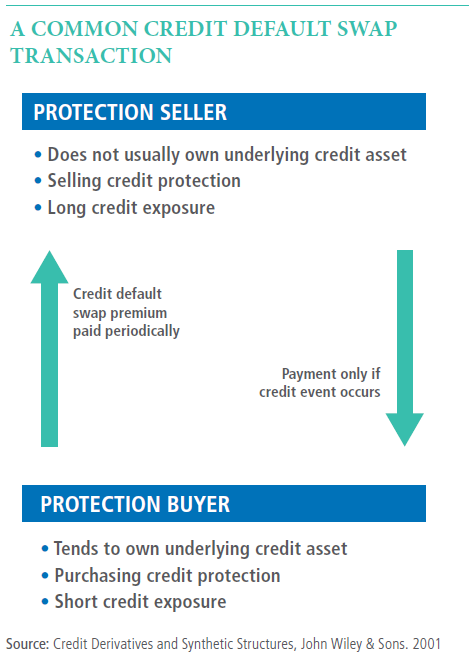

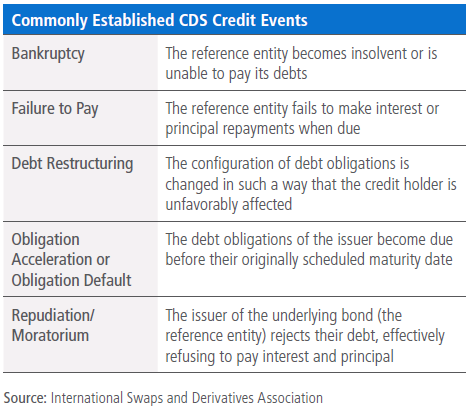

In a CDS, one party “sells” risk and the counterparty “buys” that risk. The “seller” of credit risk – who also tends to own the underlying credit asset – pays a periodic fee to the risk “buyer.” In return, the risk “buyer” agrees to pay the “seller” a set amount if there is a default (technically, a credit event). CDS are designed to cover many risks, including: defaults, bankruptcies and credit rating downgrades. (For a more detailed list of CDS credit events see the Commonly Established CDS Credit Events table below).

The graphic below illustrates the credit default swap transaction between the risk “seller,” who is also the protection “buyer,” and the risk “buyer,” who is also the protection “seller.”

What are the characteristics of credit default swaps?

The credit default swap market is generally divided into three sectors:

- Single-credit CDS referencing specific corporates, bank credits and sovereigns.

- Multi-credit CDS, which can reference a custom portfolio of credits agreed upon by the buyer and seller,

- CDS index. The credits referenced in a CDS are known as “reference entities.” CDS range in maturity from one to 10 years although the five-year CDS is the most frequently traded.

Credit default swaps provide a measure of protection against previously agreed upon credit events. Below are the most common credit events that trigger a payment from the risk “buyer” to the risk “seller” in a CDS.

The settlement terms of a CDS are determined when the CDS contract is written. The most common type of CDS involves exchanging bonds for their par value, although the settlement can also be in the form of a cash payment equal to the difference between the bonds’ market value and par value.

The CDS market was originally formed to provide banks with the means to transfer credit exposure and free up regulatory capital. Today, CDS have become the engine that drives the credit derivatives market. The growth of the CDS market is due largely to CDS’ flexibility as an active portfolio management tool with the ability to customize exposure to corporate credit. Today the CDS market represents more than $10 trillion in gross notional exposure1.

In addition to hedging credit risk, the potential benefits of CDS include:

- Requiring only a limited cash outlay (which is significantly less than for cash bonds)

- Access to maturity exposures not available in the cash market

- Access to credit risk with limited interest rate risk

- Investments in foreign credits without currency risk

- At times, more liquidity than investing in the underlying cash bonds

The performance of credit default swaps, like that of corporate bonds, is closely related to changes in credit spreads. This sensitivity makes them an effective tool for portfolio managers to hedge or gain exposure to credit. Credit default swaps also allow for arbitrage opportunities.

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and the current low interest rate environment increases this risk. Current reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Derivatives may involve certain costs and risks, such as liquidity, interest rate, market, credit, management and the risk that a position could not be closed when most advantageous. Investing in derivatives could lose more than the amount invested. Credit default swap (CDS) is an over-the-counter (OTC) agreement between two parties to transfer the credit exposure of fixed income securities; CDS is the most widely used credit derivative instrument.

There is no guarantee that these investment strategies will work under all market conditions or are suitable for all investors and each investor should evaluate their ability to invest long-term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision.

This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.

PIMCO provides services only to qualified institutions and investors. This is not an offer to any person in any jurisdiction where unlawful or unauthorized. | Pacific Investment Management Company LLC, 650 Newport Center Drive, Newport Beach, CA 92660 is regulated by the United States Securities and Exchange Commission. | PIMCO Investments LLC, U.S. distributor, 1633 Broadway, New York, NY, 10019 is a company of PIMCO. | PIMCO Europe Ltd (Company No. 2604517) and PIMCO Europe Ltd - Italy (Company No. 07533910969) are authorised and regulated by the Financial Conduct Authority (25 The North Colonnade, Canary Wharf, London E14 5HS) in the U.K. The Italy branch is additionally regulated by the CONSOB in accordance with Article 27 of the Italian Consolidated Financial Act. PIMCO Europe Ltd services and products are available only to professional clients as defined in the Financial Conduct Authority’s Handbook and are not available to individual investors, who should not rely on this communication. | Pimco Europe GmbH (Company No. 192083, Seidlstr. 24-24a, 80335 Munich, Germany) is authorised and regulated by the German Federal Financial Supervisory Authority (BaFin) (Marie-Curie-Str. 24-28, 60439 Frankfurt am Main) in Germany in accordance with Section 32 of the German Banking Act (KWG). The services and products provided by Pimco Europe GmbH are available only to professional clients as defined in Section 31a para. 2 German Securities Trading Act (WpHG). They are not available to individual investors, who should not rely on this communication. | PIMCO (Schweiz) GmbH (registered in Switzerland, Company No. CH-020.4.038.582-2), Brandschenkestrasse 41, 8002 Zurich, Switzerland, Tel: + 41 44 512 49 10. The services and products provided by PIMCO (Schweiz) GmbH are not available to individual investors, who should not rely on this communication but contact their financial adviser. | PIMCO Asia Pte Ltd (501 Orchard Road #09-03, Wheelock Place, Singapore 238880, Registration No. 199804652K) is regulated by the Monetary Authority of Singapore as a holder of a capital markets services licence and an exempt financial adviser. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Asia Limited (Suite 2201, 22nd Floor, Two International Finance Centre, No. 8 Finance Street, Central, Hong Kong) is licensed by the Securities and Futures Commission for Types 1, 4 and 9 regulated activities under the Securities and Futures Ordinance. The asset management services and investment products are not available to persons where provision of such services and products is unauthorised. | PIMCO Australia Pty Ltd ABN 54 084 280 508, AFSL 246862 (PIMCO Australia) offers products and services to both wholesale and retail clients as defined in the Corporations Act 2001 (limited to general financial product advice in the case of retail clients). This communication is provided for general information only without taking into account the objectives, financial situation or needs of any particular investors. | PIMCO Canada Corp. (199 Bay Street, Suite 2050, Commerce Court Station, P.O. Box 363, Toronto, ON, M5L 1G2) services and products may only be available in certain provinces or territories of Canada and only through dealers authorized for that purpose. | PIMCO Latin America Edifício Internacional Rio Praia do Flamengo, 154 1o andar, Rio de Janeiro – RJ Brasil 22210-906. | No part of this publication may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America L.P. in the United States and throughout the world. ©2017, PIMCO.

CMR2016-1228-239272