Dealing With an Inflation Head Fake

- We forecast a strong global recovery in 2021 amid significant fiscal support, accommodative monetary policy, diminishing lockdowns, and accelerating vaccinations.

- Despite an expected temporary bump in inflation in the coming months, we believe inflation generally will remain below central bank targets over the next one to two years. However, markets may remain focused on inflation risks in the near term, contributing to elevated volatility.

- In this uncertain environment, we seek to maintain portfolio flexibility and liquidity to be able to respond to events as they unfold.

- We see opportunities in COVID-recovery sectors, including housing, industrial/aerospace, and select banks and financials. We favor non-agency U.S. mortgages and select other global structured products. We favor curve-steepening positions in several developed market sovereigns, and we expect to maintain an overweight to equities in asset allocation portfolios.

Investors should be prepared for an inflation "head fake" and look to maintain portfolio flexibility and liquidity to be able to respond to events in what is likely to be a difficult and volatile investment environment.

These are two of the key takeaways from our latest Cyclical Forum and strategy meetings, in virtual format again but bringing together the whole of PIMCO's global team of investment professionals. Our economic teams laid out the baseline forecast for a strong recovery across the world and inflation that – in spite of all the reflationary talk – we think is likely to remain below central bank targets over the next one to two years, notwithstanding a temporary spike over the next several months (which could cause a "head fake" in markets). We will lay out that baseline and the risks around it below.

But, those forecasts aside, our forum discussion often returned to the potential for financial markets to maintain focus on inflation risks, at a time when central banks globally have pledged to go very slow and when fiscal policy, this year at least, should boost growth – with a very big boost indeed in the U.S.

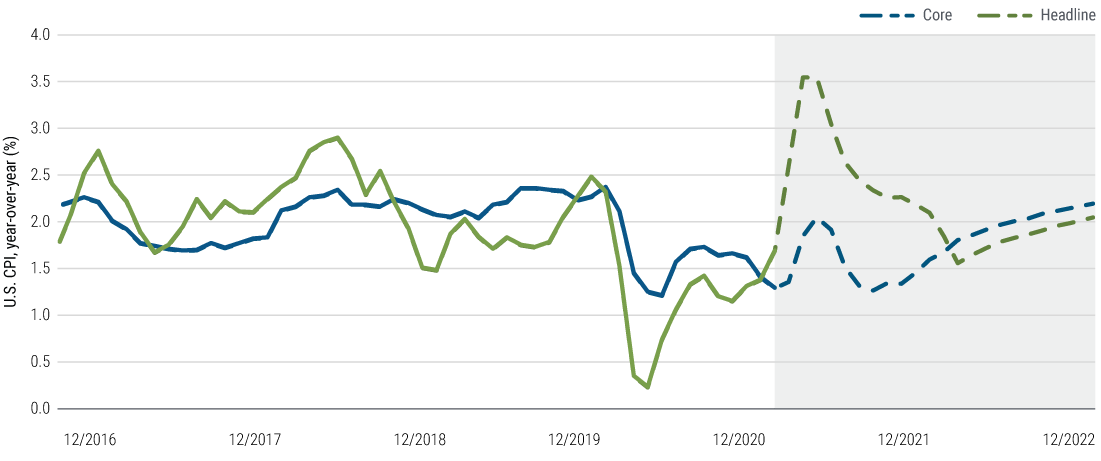

We have seen a sharp rise in bond yields, albeit from low levels, and a rise in volatility. The front ends of yield curves have tested, a little at least, the thesis that central bankers will hold their nerve and stick to their long-term patient planning. It is quite likely in our forecasts that the coming near-term rise in inflation won't be sustained (see Figure 1). But it also seems quite likely that financial markets will continue to remain focused on upside inflation risks in the near term and that volatility will continue to be elevated, compared with recent history at least.

Meanwhile, the good news on vaccines and the economic expansion should be mostly priced in. Indeed, we need the expectations of medical efficacy and strong recovery to be vindicated to validate risk asset valuations that we think are fair to somewhat frothy. But it remains the case that this is a very different economic cycle, coming out of a recession driven by lockdowns and voluntary social distancing rather than underlying economic and financial strains, and there is a higher than usual amount of uncertainty in the outlook.

While there is a lot of potential for medium-term economic scarring, there is likely to be a strong cyclical boom this year. And it is a very unusual combination: growth that is likely to be as strong as all but the most seasoned of analysts have witnessed, combined with a new fiscal orthodoxy – to a greater or lesser extent in the U.S. and Europe, respectively – that has shifted to a focus on securing that ongoing recovery above all else, plus a central bank focus on lifting inflation and achieving inclusive maximum employment, again with different degrees of commitment across countries. An inflation head fake it might turn out to be, but we understand why there might be some elevated uncertainty about the true direction of travel.

Investment conclusions: Flexibility and liquidity

In this environment, with the potential for ongoing volatility, we seek to maintain flexibility in our portfolio positioning to be able to respond to events as they unfold. This includes careful scaling of positions, very careful liquidity management, and – in some cases – staying close to benchmark weights for now as we look to be better able to take advantage of compelling opportunities later. Given current valuations, we see little cost in going "up in liquidity," and a patient approach now should allow us to be aggressive in seizing the good opportunities that are likely to arise in a more volatile environment.

Duration

We expect to be fairly close to home in terms of duration, with interest rates at more reasonable levels after the recent market moves. Based on a 1% to 2% range for the U.S. 10-year Treasury bond yield, we expect to move further into the higher end of the range in the near term. But, while markets will continue to speculate about the extent of central banks' resolve, and we certainly have the environment for possible overshooting relative to fundamentals, we do not expect any big shift in global yields as we leave the COVID period behind compared with the levels that were prevailing before the COVID shock. We believe that bonds continue to serve as both a store of value and a potent hedge for risk assets in terms of overall asset allocation. (For further insights, please read PIMCO's recent research paper, "The Discreet Charm of Fixed Income.")

Among the larger central banks, the U.S. Federal Reserve, the Bank of Japan, and the Bank of England have reacted with relative equanimity to the recent market moves, seeing these as the result of a stronger outlook. The European Central Bank may have been more concerned about higher yields, though its recent communications have made it somewhat hard to tell, in holistic and multifaceted ways.

In most cases, central banks tend to be more concerned about expectations for rate hikes being priced into the front ends of yield curves rather than the level of longer-dated yields. This observation, together with inflation head fake concerns, reinforces our long-standing structural bias toward curve steepening positions. Given the steepening we have already witnessed in the U.S., there is also a good case for global diversification in expressing this curve-steepening view across the U.K., Europe, and Japan.

Credit

We expect to continue to have overweights overall in spread sectors. In our view, U.S. non-agency mortgage-backed securities (MBS) and some other global structured products, including U.K. residential MBS, offer good valuations versus generic cash corporate bonds as well as good defensive qualities, as was demonstrated by their overall resilience during the pandemic-induced market shock in 2020.

In corporate credit, we see the valuation and liquidity offered by credit default swap indices as attractive versus cash corporate bonds in most cases. But we will continue to emphasize alpha generation in credit single-name selection with the help of our global team of credit portfolio managers and analysts. We see attractive opportunities in COVID-recovery sectors, housing, industrial/aerospace, and select banks and financials, and we will likely maintain a focus on these opportunities in credit-focused strategies. We also expect private credit strategies to benefit from an environment in which long-term investors who can tolerate the elevated risks can look to extract attractive liquidity premiums.

Currencies and emerging markets

While the current period of heightened volatility will tend to counsel for lower exposure to currency trades, our baseline view is that the combination of strong growth across countries and the U.S. Fed's commitment to be very slow in raising short-term interest rates should be consistent with further modest U.S. dollar depreciation over time. In our portfolios, this may suggest some exposure to high-quality emerging market (EM) currencies, but overall we expect to be quite cautious on tactical exposures to EM assets during a period where higher volatility may continue to weigh on EM assets.

Equities

In asset allocation portfolios, we expect to maintain an overweight to equities, with a preference for cyclical over defensive stocks. In spite of recent volatility, company fundamentals remain generally sound, as indicated by the most recent earnings season and corporate earnings guidance. Sector and security selection remain critical and we favor securities exposed to fiscal stimulus, the cyclical recovery, and secular disruptions in technology. We also continue to favor equity markets in the U.S. and Asia, regions that appear likely to emerge from the pandemic earlier and should benefit from fiscal support measures.

Commodities

We see modest upside for commodities, driven by accelerating global growth, investment in infrastructure, and generally tight levels of current inventories. However, we expect aggregate price gains to be limited. We do not believe that we are at the start of a new commodity supercycle because we do not see broad tightness across the majority of markets. Taking oil as an example, while inventories have drawn down and demand is recovering strongly, OPEC market share is at multi-decade lows, incremental shale supply can come online at prices around today's values, and the cost of energy from renewables continues to fall each year. Given the importance of oil within the overall commodity complex along with continued technological innovation, we find a supercycle in commodities very unlikely.

Economic outlook: Up, up, up

Global growth now looks set to rebound even more strongly in 2021 than we'd anticipated in our January Cyclical Outlook. Governments have stepped up fiscal support significantly since then, and the accelerating vaccine rollout should permit a ramping-up of economic activity in COVID-constrained service sectors over the next couple of quarters.

As a consequence, following a 3.5% contraction in 2020, we now forecast world GDP growth (at current exchange rates) in excess of 6% in 2021, up from 5% previously. In our 2021 forecasts, growth in China is likely to exceed 8%, the U.S. won't be far behind at 7% plus, and even relative growth laggards like the euro area and Japan should achieve above-trend growth of some 4% and 3%, respectively. Our tentative forecasts for 2022 envisage growth that is still above trend but moderating, reflecting a further normalization of the global health situation, monetary policies that remain broadly supportive, but a waning or even negative fiscal impulse in many countries as emergency support measures expire and tax increases come into play.

A bumpy inflation path...

In our baseline outlook, consumer price inflation – both headline and, to a lesser extent, core – will be on a bumpy path this year across countries. This may lead to gyrations in longer-term inflation expectations and, as discussed earlier, a potential inflation head fake in bond markets.

Over the next several months, a combination of base effects, recent increases in energy prices, and price adjustments in sectors where activity ramps up is likely to push year-over-year inflation rates significantly higher. However, we forecast that much of this rise will reverse later this year as full employment remains elusive despite the expected strong labor market recovery. Overall, our baseline foresees core inflation remaining below central banks' targets in all major developed economies in 2021 and 2022.

...with upside and downside risks

That said, we need to be mindful of upside inflation risks from a variety of sources. To name a few, economic growth and employment gains could surprise on the upside, energy prices could surge further, supply chain price pressures in the tech sector (semiconductors, etc.) could feed into goods prices, and enhanced monetary-fiscal coordination might push inflation expectations higher.

Conversely, downside risks to inflation could materialize if companies accelerate automation and digitalization in response to the pandemic, or if the ongoing boom in asset prices turns into bust. Overall, as we indicated in our 2020 Secular Outlook, the outlook for inflation – especially over the medium and longer term – has become more uncertain.

Central banks likely to stay the course

Regarding monetary policy, with "substantial progress" toward its employment and inflation goals likely in the course of 2021, we expect the Fed to initiate a gradual tapering of its asset purchases late this year or early next year. In order to avoid another taper tantrum, this move is likely to be signaled well in advance and accompanied by reassurances that rate hikes are not on the horizon until well after the end of tapering.

While markets are currently priced for an initial Fed rate hike in early 2023, the Fed's new framework of aiming at inclusive maximum employment and average inflation of 2% suggests to us a later timing, based on our forecasts (see the U.S. section below). Our view is in line with the latest guidance from the March 2021 Fed meeting, where the majority of participants continued to project unchanged rates until 2024.

The precise path of European Central Bank (ECB) asset purchases over the cyclical horizon appears less predictable given the muddled communication about what "preserving favorable financing conditions" means. We believe this reflects an apparent rift within the governing council over how aggressive the ECB should push back on rising yields and indeed over the extent of the central bank's commitment to its inflation target, given this debate is occurring at a time when the ECB staff is forecasting inflation closer to 1% than 2% as far out as 2023. Overall, we think the "ECB put" remains in place, but the ECB is likely to be reactive rather than proactive in response to changes in financial conditions.

Regional forecast snapshots

United States: Expect the fastest growth in almost 40 years

Tiffany Wilding and Allison Boxer

We expect U.S. real GDP growth to exceed 7% in 2021, as massive fiscal stimulus combines with an improved public health situation to create a surge in economic activity. Though off a low base, this would be the fastest pace of U.S. real GDP growth since 1984. COVID-19 vaccinations are now well underway, consistent with our expectation that the majority of the population will be vaccinated by the end of the second quarter. The additional COVID-19-focused fiscal stimulus that passed in December and March amounts to nearly $3 trillion and is estimated to contribute 2.5–3 percentage points to 2021 real growth. We expect growth to decelerate meaningfully in 2022 to 3%, but remain above trend, as the sharp decline in the fiscal impulse is offset by continued reopening and recovery.

Despite this bright growth outlook, we have only moderately upgraded our inflation outlook for 2022 and beyond. While we expect a period of elevated inflation in the second quarter of 2021 due to base effects and price volatility for COVID-sensitive sectors, we continue to see core consumer price index (CPI) inflation ending 2021 around 1.7% year-over-year and accelerating only gradually to 2.2% y/y by year-end 2022. Our near-term inflation forecast is muted because we believe there is still significant slack in the U.S. economy and it will take time for stronger growth to affect prices.

We expect the Fed to slowly reduce the level of monetary policy accommodation by tapering asset purchases in late 2021 or early 2022. However, we continue to expect a prolonged period before the Fed raises rates. Fed officials have clearly indicated they need to see a complete and inclusive recovery in the labor market and inflation sustainably at 2% before raising interest rates. According to our forecasts, and according to the Fed's own March 2021 forecasts, the Fed won't reach these goals until at least 2023.

Real GDP growth above 7% has only happened in the U.S. a few times over the past 50 years. Nonetheless, we think the risks around our outlook are balanced. On the upside, strong pent-up demand could spur an even faster drop in household savings than we anticipate. On the downside, new virus variants could significantly derail the recovery. The outlook for U.S. fiscal policy is also highly uncertain: Our baseline assumes the U.S. passes an infrastructure package, partially offset by modest tax hikes, but the details and likelihood remain unclear.

Euro area: Accelerating vaccinations to drive economic rebound

After a disappointingly slow start, vaccinations in the EU look set to gather pace from the spring, as supply from existing vaccine suppliers improves and new vaccines come online. We expect the more vulnerable populations – the elderly and healthcare workers – will be immunized by late Q2, a time at which European economies can start to emerge from winter lockdowns in a more sustained way. Economic growth at this point should accelerate briskly, but full normalization will take time given a gradual removal of restrictions, lingering caution, and some scarring effects from the crisis. We see euro area activity reaching its pre-crisis level in the first half of 2022, and we forecast GDP growth above 4% in 2021 and nearly 5% in 2022.

As for inflation, we anticipate a lot of volatility over the coming eighteen months, driven in good part by distortions from tax changes and CPI basket weight changes. But, beyond these distortions, we see inflationary pressures remaining muted given ample slack in the economy. We see core inflation averaging below 1% in both 2021 and 2022. In this context, the ECB looks set to remain supportive, keeping rates unchanged and continuing to add to its asset purchase program through the end of 2022. Fiscal policy also looks set to remain stimulative – helped in part by EU Recovery Fund disbursement from midyear 2021 – though orders of magnitude less than in the U.S.

We see risks as broadly balanced around the projections. The key upside risk is a greater release of pent-up demand as economies reopen, while key downside risks concern the speed and efficacy of vaccination programs and a greater degree of scarring in labor markets and companies heavily affected by the crisis. Fiscal policy could also be a swing factor for the outlook, though mostly beyond 2022, as European fiscal rules look set to remain suspended next year.

United Kingdom: Playing catch-up

The vaccine rollout in the U.K. is off to a quick start, and the government is on track to remove most restrictions by early summer. We expect activity to rebound fairly quickly from the second quarter, gradually catching up with activity in the rest of Europe, having fallen more sharply in 2020. We do not expect the U.K.'s departure from the EU to have any major economic effects in our baseline outlook for 2021 and beyond. Fiscal policy, meanwhile, is likely to mechanically turn contractionary in 2021 and onward, as COVID-related emergency measures gradually roll off. On balance, like in Europe, we see U.K. GDP returning to its pre-pandemic level in the first half of 2022, with GDP growth of around 5% in 2021 and 6% in 2022.

U.K. inflation looks set to increase over the cyclical horizon, but like in Europe it will be a volatile journey, with changes to both CPI basket weights and tax policy adding some temporary noise. Distortions aside, we continue to see underlying inflationary pressures running below the Bank of England's (BOE) 2% target, still hindered by high levels of economic slack. We expect core inflation to average 1.3% in 2021 and 1.9% in 2022. In this context, the BOE looks set to gradually taper its asset purchases from summer 2021 onward and finish its net purchases by year-end. On policy rates, however, we think the BOE is unlikely to tighten policy ahead of the Fed, sometime beyond the end of the cyclical horizon.

The key upside risk is a sharper-than-expected rebound in consumption, driven by a faster normalization of the household savings rate. Downside risks relate to more severe pandemic-related scarring, especially in the labor market.

Japan: Looser yield curve control

We expect Japan's GDP to grow 3% in 2021 mainly due to large fiscal stimulus (around 4% of GDP) and private domestic demand gradually normalizing after a sharp decline in 2020. With vaccine distribution likely to be slower than in other major countries, the recovery phase is also likely to be slower, but momentum should extend into 2022. We see risks as broadly balanced with potential downside risk coming from delays in vaccine and upside risk coming from a stronger-than-expected recovery in private sector demand.

On inflation, we expect Japan's headline CPI to remain below 0% in 2021 despite the recovery in growth. One-off factors such as the travel subsidy program and the mobile phone charge cut as well as a large output gap are likely to keep a lid on inflationary pressures over the cyclical horizon.

As achieving the 2% inflation target becomes even more remote, the Bank of Japan's (BOJ) easy stance is likely to be extended further. The BOJ conducted a policy review at the March 2021 meeting and made an effort to increase the sustainability of current monetary policy, which we believe could lead to further reduction in the amount of Japanese government bond (JGB) purchases to allow some market volatility once the COVID-19 situation improves as expected by mid to late this year. However, the BOJ is still likely to contain any sharp rise in yields within the 10-year maturity under the new 10-year JGB band at a 0% +/- 0.25% range.

China: Credit creation to moderate

We expect GDP growth in China to rebound to above 8% in 2021 from last year's low base, with consumption taking the lead. The 2020 recovery was mainly driven by policy-supported investment and strong external demand, of which the momentum likely will fade in 2021 as policy normalization starts and global manufacturing catches up. However, manufacturing investment likely will strengthen as business sentiment improves and the country refocuses on industry upgrading and supply chain security, while infrastructure and housing fixed asset investment (FAI) may moderate due to fiscal tapering and property market tightening.

The anticipated strong global growth rebound, thanks to vaccination progress and generous fiscal packages in many countries, has fueled commodity prices and will likely push inflation temporarily higher. But for China, the pass-through should be partly offset by pork price normalization as the sector recovers from the swine flu. Thus, we forecast headline CPI inflation likely will remain subdued and average 1%–2% during 2021. Macro policies should normalize at a gradual and moderate pace. The government has pledged no sharp policy turns in an effort to foster a solid recovery. However, risk prevention is regaining policymakers' attention. We therefore expect a moderation in credit growth and the fiscal deficit following the spike in 2020, with policy rates and the reserve requirement ratio (RRR) kept unchanged through 2021.

The downside risks in the near term include U.S.–China frictions, a sluggish recovery in consumption constrained by lingering public health concerns, and export underperformance as global competition resumes. Looking to upside risks, a brighter-than-expected global outlook and easing U.S.–China tensions could further boost China's recovery. Going into 2022, we expect a continued normalization of macro conditions, with growth returned to trend at 5%–6% y/y, and policies well-calibrated to balance growth with risk prevention. The new 14th Five-Year Plan (2021–2025) focuses on quality growth and productivity improvement, with an emphasis on innovations, domestic demand, income equality, and decarbonization.

Emerging markets: A multi-speed recovery

Our macro outlook for emerging markets is constructive, with marked differentiation in convergence speed driven by the pace of vaccinations, services and tourism recovery, the domestic policy stance, and the impact from higher commodity prices. Vaccination rollout and expected time to herd immunity in EM lags developed markets by about two or three quarters, with most emerging markets expected to reach herd immunity only by the end of 2022. Currently the UAE and Chile are leading, while Latin America (e.g., Peru) and some Asian economies (e.g., the Philippines) and those that have yet to secure vaccine supply are lagging behind. As a result, EM output gaps are forecast to close at differing speeds with large confidence intervals on the 2021 and 2022 BRIM growth forecasts of 6.6% and 4.0%, respectively (BRIM collective forecasts reflect the GDP-weighted average of forecasts for Brazil, Russia, India, and Mexico).

We expect BRIM inflation to rise in 2021 to 4.7% y/y due to a combination of base effects, higher food and commodity prices, and foreign exchange pass-through. In most cases, our end-2021 forecasts for EM economies are below the respective central bank inflation targets, but the risks are to the upside. Ongoing strength in commodities could add 2 to 4 percentage points to headline CPI, increasing risks of contamination of core inflation and possibly warranting a policy response. This alongside large output gaps and constrained fiscal/debt servicing costs means that monetary policy in 2021 will likely be even more complex and differentiated across EM than before. Over the cyclical horizon, we see Brazil and Russia hiking rates, South Africa and India staying on hold, and Mexico potentially easing further. At the same time, we expect 2021 fiscal balances to improve by about 2%–3% of GDP but the fiscal landscape to remain challenging for many countries, leaving limited room for further fiscal stimulus.

Other risk factors for EM are broadly balanced. Looking at the political calendar, there are key elections in Mexico where the incumbent party is expected to retain a majority. We expect fallen angel ratings and credit risks are confined to smaller EM countries with low index exposure, such as Romania and Colombia. And the increase in IMF special drawing right (SDR) allocations we expect to see in April 2021 could be positive for many high-yielding EMs with low reserve coverage.

Download PIMCO's Cyclical Outlook

Download PDFAbout our forums

Honed over 50 years and tested in virtually every market environment, PIMCO’s investment process is anchored by our Secular and Cyclical Economic Forums. Four times a year, our investment professionals from around the world gather to discuss and debate the state of the global markets and economy and identify the trends that we believe will have important investment implications.

At the Secular Forum, held annually, we focus on the outlook for the next three to five years, allowing us to position portfolios to benefit from structural changes and trends in the global economy. Because we believe diverse ideas produce better investment results, we invite distinguished guest speakers – Nobel laureate economists, policymakers, investors, and historians – who bring valuable, multidimensional perspectives to our discussions. We also welcome the active participation of the PIMCO Global Advisory Board, a team of world-renowned experts on economic and political issues.

At the Cyclical Forum, held three times a year, we focus on the outlook for the next six to 12 months, analyzing business cycle dynamics across major developed and emerging market economies with an eye toward identifying potential changes in monetary and fiscal policies, market risk premiums, and relative valuations that drive portfolio positioning.

Featured Participants

Disclosures

Past performance is not a guarantee or a reliable indicator of future results.

All investments contain risk and may lose value. Investing in the bond market is subject to risks, including market, interest rate, issuer, credit, inflation risk, and liquidity risk. The value of most bonds and bond strategies are impacted by changes in interest rates. Bonds and bond strategies with longer durations tend to be more sensitive and volatile than those with shorter durations; bond prices generally fall as interest rates rise, and low interest rate environments increase this risk. Reductions in bond counterparty capacity may contribute to decreased market liquidity and increased price volatility. Bond investments may be worth more or less than the original cost when redeemed. Mortgage- and asset-backed securities may be sensitive to changes in interest rates, subject to early repayment risk, and while generally supported by a government, government-agency or private guarantor, there is no assurance that the guarantor will meet its obligations. Corporate debt securities are subject to the risk of the issuer's inability to meet principal and interest payments on the obligation and may also be subject to price volatility due to factors such as interest rate sensitivity, market perception of the creditworthiness of the issuer and general market liquidity. Investing in foreign-denominated and/or -domiciled securities may involve heightened risk due to currency fluctuations, and economic and political risks, which may be enhanced in emerging markets. Currency rates may fluctuate significantly over short periods of time and may reduce the returns of a portfolio. The credit quality of a particular security or group of securities does not ensure the stability or safety of the overall portfolio. Credit default swap (CDS) is an over-the-counter (OTC) agreement between two parties to transfer the credit exposure of fixed income securities; CDS is the most widely used credit derivative instrument. Private credit involves an investment in non-publically traded securities which may be subject to illiquidity risk. Portfolios that invest in private credit may be leveraged and may engage in speculative investment practices that increase the risk of investment loss. Equities may decline in value due to both real and perceived general market, economic and industry conditions. Commodities contain heightened risk including market, political, regulatory, and natural conditions, and may not be appropriate for all investors.

Statements concerning financial market trends or portfolio strategies are based on current market conditions, which will fluctuate. There is no guarantee that these investment strategies will work under all market conditions or are appropriate for all investors and each investor should evaluate their ability to invest for the long term, especially during periods of downturn in the market. Investors should consult their investment professional prior to making an investment decision. Outlook and strategies are subject to change without notice.

Forecasts, estimates and certain information contained herein are based upon proprietary research and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. There is no guarantee that results will be achieved.

Alpha is a measure of performance on a risk-adjusted basis calculated by comparing the volatility (price risk) of a portfolio vs. its risk-adjusted performance to a benchmark index; the excess return relative to the benchmark is alpha.

PIMCO as a general matter provides services to qualified institutions, financial intermediaries and institutional investors. Individual investors should contact their own financial professional to determine the most appropriate investment options for their financial situation. This material contains the opinions of the manager and such opinions are subject to change without notice. This material has been distributed for informational purposes only and should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed. No part of this material may be reproduced in any form, or referred to in any other publication, without express written permission. PIMCO is a trademark of Allianz Asset Management of America LLC in the United States and throughout the world. ©2023, PIMCO.

CMR2021-0319-1571814